Most people plan to save after paying the bills, but the balance rarely grows. A better system is to move savings first, then spend what is left. In this guide, we break down a simple salary flow you can copy today, with rules and tools that work in India.

Why your salary flow matters

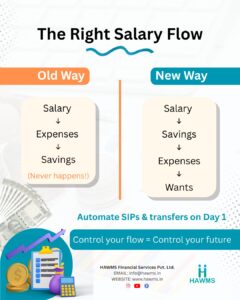

Your monthly flow decides who gets paid first. If expenses win, savings lose. If savings win, your future is funded before lifestyle expands. The model is simple. Salary → Savings → Expenses → Wants. Automate this once and you will stop fighting willpower every month.

What the old way looks like

Old Way: Salary → Expenses → Savings.

Problem. There is always a festival, a sale, or an emergency. Savings keep getting pushed to “next month”.

What the new way looks like

New Way: Salary → Savings → Expenses → Wants.

Fix. You set your saving amount on day one, move it out automatically, and run the month on the rest.

The rule to start with

-

Decide your saving number.

-

Automate SIPs and transfers on payday.

-

Spend only what remains.

If you already have loans, start small and increase as you clear EMIs. The habit matters more than the starting amount.

How to set up how to save money from salary in one weekend

Step 1. Pick your buckets

Use four buckets.

-

Safety. Emergency fund in bank FD or liquid fund.

-

Growth. Equity mutual fund SIPs, index funds.

-

Goals. Short and medium goals like school fees or travel.

-

Expenses. The account you swipe from daily.

Move money to Safety and Growth first. Expenses get what is left.

Step 2. Automate on day one

-

SIPs. Set date between 1 and 5.

-

Recurring transfers. Fixed amounts to Safety and Goals.

-

Salary sweep. If your salary account pays low interest, sweep the extra to a better account or FD.

Automation is your friend. It makes your plan run even on busy months.

Step 3. Cap lifestyle

-

Keep a monthly Wants budget. Put it in a separate wallet or UPI account.

-

When the wallet is empty, stop.

-

If you must buy, move it to next month’s list. Delayed decisions reduce regret buys.

Step 4. Review once a month

-

Check savings rate, not just balance.

-

Aim for a steady uptrend in your net worth.

-

If expenses keep rising, trim the biggest three line items first.

India-specific tips that make the flow stick

Handle subscriptions

Track all auto-debits for 90 days. Keep the ones you use every week. Pause the rest. This single step can free up a few thousand rupees per month.

Fix lifestyle inflation

When you get a raise, increase SIPs first by the same percentage. Then adjust spending. Let the system capture growth before lifestyle does.

Protect the downside

-

Health insurance for family.

-

Term cover for income protection.

-

Avoid mixing insurance and investment unless you fully understand the trade-offs.

Build the emergency fund

Target six months of expenses. Keep it liquid. This keeps you from breaking SIPs during job gaps or medical costs.

Five common blockers and easy fixes

-

No clear monthly expense number

Track for 30 days. Group into Needs, Wants, EMIs, and Transfers. Knowing the number removes guesswork. -

Impulse online purchases

Use a 48-hour rule for non-essentials. Most wants fade in two days. -

Cashflow mismatch

If rent and EMIs hit before salary, shift due dates or keep a one-month buffer in the Expenses account. -

Multiple small loans

Close high-interest loans first using the avalanche method. Roll freed EMI into SIPs. -

Single-account chaos

Use at least two accounts. One for investments and goals, one for spends. Clean separation makes discipline easy.

Practical examples for Kerala families

-

Working couple with school-going kids

Pay yourself 25 percent into SIPs and Safety before bills. Keep a dedicated bucket for school fees. Top up the emergency fund during monsoon months when home repairs are likely. -

Gulf NRI supporting parents in Kerala

Keep foreign salary in NRE and India income in NRO to avoid mixing. Automate a fixed monthly transfer for parents into their account. Review currency costs once a quarter. -

Single professional starting out

Begin with a 10 percent SIP and raise it by 2 percent every quarter. The salary grows, so your investments grow even faster.

FAQs we get all the time

What if my income is variable

Use percentages, not fixed numbers. On low months, you save less, but the system stays intact.

Is cash back credit card a strategy

Use it only if you pay in full every month. If you carry a balance, rewards are not worth the interest.

Can I skip a month

If you must, skip Wants, not Savings. Keep the habit alive with even a small transfer.

How to track progress in 10 minutes a month

-

Savings rate. Savings divided by take-home. Aim for 20 to 30 percent over time.

-

SIP total. Check if it increased after your last raise.

-

Emergency fund months. Keep it near six.

-

Net worth trend. Slow and steady up is the signal.

Bring it all together

The right flow turns planning from a monthly fight into a quiet default. You decide once and let automation do the work. Your savings happen first, lifestyle fits the rest, and you stop feeling guilty about money.

If you want a longer roadmap after you fix the flow, read our step-by-step plan here.

5-Year Plan to Financial Freedom India

HAWMS Services

Need a quick setup call

Message us on WhatsApp and we will map your buckets, SIP dates, and auto-transfers in 15 minutes.

Watch a short explainer on SIP basics

Our most asked questions answered in one video.

YouTube