If you are from Kerala, working in the Gulf, sending money home, and supporting family, you have one big question: how does NRI taxation India actually work and what part of your income is taxed in India. This matters because getting it wrong can lead to TDS cuts, tax notices, or blocked remittance later.

How NRI taxation india actually works

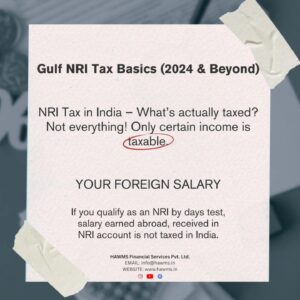

First thing. India does not tax everything you earn abroad. If you qualify as a Non-Resident Indian for that year, India usually taxes only the income that is earned in India or received in India, not your full Gulf salary. Your global income becomes taxable in India only if you are treated as a resident for that financial year.

This is where most Malayali NRIs panic for no reason. Salary from Dubai or Muscat or Doha, paid for work done outside India, and kept outside India, is normally not taxed in India if you are an NRI for that year. But rent from your Kerala house, money sitting in your NRO account, or capital gains from selling property in India can be taxable in India.

Below is a simple walk through. Read slow. This is for awareness. For final filing rules, always check the latest Income Tax Department notes here.

1. Residency decides your tax story

NRI taxation india starts with one test: are you a Resident or a Non-Resident for that financial year.

You are generally treated as Resident if:

-

You stayed in India 182 days or more in that financial year, or

-

You stayed 60 days or more in that year and 365 days or more in the 4 previous years (this 60 days limit can change to 120 days for high income cases).

If you are Resident, India can tax your global income. That means even Gulf salary can become taxable in India.

If you are NRI (Non-Resident), India taxes only income that is earned in India or received in India. This is the core logic behind nri taxation india. It is also why many NRIs keep track of their “days in India” every year.

This is also why people who work abroad but spend long time back home in Kerala during school holidays, weddings, or medical leave need to be careful. Too many days in India can flip your status without you noticing.

2. What income is actually taxed in India for an NRI

Now let us talk about what the Income Tax Department actually looks at.

For most NRIs, the following are usually taxable in India:

-

Rent from property in India

-

Interest earned in NRO accounts or NRO fixed deposits

-

Capital gains when you sell Indian property, Indian shares, or Indian mutual funds

-

Salary paid for work physically done in India

-

Business or consulting income coming from India

This is why nri taxation india is not only about your Gulf salary. It is about what money touches India.

Important: Rental income from your Kerala flat is taxable in India even if the rent is going to your NRO account and you live outside India. TDS (tax deducted at source) can apply. Many tenants are now told to deduct TDS and pay the tax before sending you the rest.

Also, interest in NRO accounts is taxable in India and banks can cut tax automatically at 30 percent plus surcharge and cess.

So if you are an NRI and you are telling yourself “I am abroad, so India cannot touch me”, that is not fully true. The system is watching money that is generated inside India.

This is where the phrase “nri and taxation in india” actually gets real. It is not about where you live. It is about where the money comes from and how it is treated on paper.

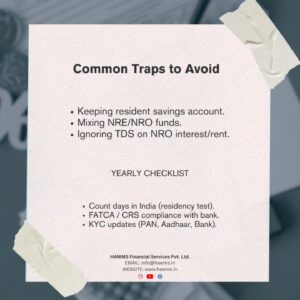

3. Common traps that hit Gulf NRIs

Here are the mistakes that we see again and again. Fixing these early can save you stress in assessment year.

-

Keeping your old resident savings account after moving abroad

If you become NRI, that account should normally be converted to NRO. Mixing funds in a normal resident account can create compliance pain later. This is one of the silent problems in nri taxation india. -

Mixing NRE and NRO money

NRE is usually for foreign income that you bring into India. NRO is for Indian income like rent, dividends, or interest. When you mix these, it becomes harder to prove what is taxable and what is not. -

Ignoring TDS on rent or NRO interest

If TDS was cut but not reported correctly, you can get mismatch alerts later. TDS and source tracing are part of how nri taxation india is enforced today. -

Not counting your days in India

You think you are still “NRI”, but on paper you crossed the day limit and became Resident. If you become Resident, India can ask you to pay tax on global income, not just Indian income.

4. How to stay compliant and file

This part is not exciting, but it is where most people mess up.

-

Keep clean proof of source

If you send money from Gulf salary to India, keep payslips and bank trail. If you get rent in Kerala, keep rent agreements and proof of TDS deducted by the tenant. -

Use the right ITR form

Most NRIs file ITR-2, depending on their income type. The form you file depends on how you earn (salary in India, capital gains, rent, etc.). -

Handle repatriation correctly

When you move funds from NRO back to your overseas account, banks usually ask for Form 15CA and 15CB. 15CB is normally certified by a CA to confirm tax has been paid. 15CA is your declaration. This is part of how the government tracks nri tax india flows and makes sure India-taxed income leaving India is reported. -

Know where to read official rules

For the latest filing rules, return types, residency rules, and tax obligations, always review the Income Tax Department portal.

This is also why NRI taxation india is not something you should only check during filing season in July. You have to maintain clarity the whole year.

5. Action plan for Malayali NRIs

Here is a practical checklist you can follow if you are from Kerala and working in the Gulf.

-

Track your India days

Put a simple counter in your phone. Residency status is the first gate in nri taxation india, and it is decided by number of days in India, not emotions. -

Separate accounts

Use NRE for foreign earnings that you bring into India. Use NRO for rent, interest, and other income from India. Do not park everything in one old resident account. -

Keep an annual tax folder

Store rent agreements, TDS slips, NRO interest statements, property sale documents, brokerage statements. You will need them if there is a question later. -

Do a basic review once a year

Ask yourself:

-

Did I get rent from Kerala property

-

Did I earn interest in NRO

-

Did I sell any property or mutual fund units that created capital gains in India

If yes, that is income the Indian system can tax.

-

Build liquidity back home

Keep an emergency fund in India for parents, health costs, or house repair. For how to structure that safety fund and long-term buckets, you can read our detailed Kerala money guide here. -

Ask early, not last minute

Before you repatriate a large sum out of India, speak to a CA. Get clarity on 15CA/15CB and TDS position. This is smarter than getting blocked by the bank when you actually need that money.

Final word

Here is the simple mindset. India is not trying to tax the full Gulf salary of every Malayali working abroad. India is trying to tax money that is created inside India, or received in India, and link that money to the right person. That is the heart of nri taxation india.

If you keep clean accounts, file right, and track your residency days, you stay safe. If you ignore it, you get flagged.

Need personal help with this

We can walk you through residency status, NRE vs NRO, rent income, TDS, forms, and filing. We work with Malayalis, Gulf NRIs, and returning professionals who want clarity on nri and taxation in india before they make big money moves.