Still confused about bank accounts after you move abroad. You are not alone. Most Malayalis working in the Gulf hear random advice from friends and bankers, and end up using the wrong account. This blog will break down NRE vs NRO vs Resident Account in simple language so you know which one is right for you, and what to fix if you already made a mistake.

Why NRE vs NRO vs Resident Account matters

This is not a small topic. It affects tax, money transfer, and even legal compliance. If you are an NRI and you keep using your old resident savings account in India, that can cause trouble later. If you mix rent from India and foreign salary in one account, that can trigger questions. If you want to send money back out of India to your Gulf account, the account type matters.

In short, choosing the right account is not about paperwork. It is about control. Many people only learn this after the bank blocks a big transfer. Understanding NRE vs NRO vs Resident Account early can save stress, tax issues, and delays.

What is an NRE account

NRE stands for Non Resident External.

Who should use it

-

People earning money abroad. Example: Gulf salary.

Why it exists

-

You can bring your foreign income into India and keep it in rupees.

Key benefits

-

You can send the money back abroad any time without restriction.

-

Interest you earn in this account is usually tax free in India.

Good for

-

Parking your overseas income in India

-

Investing money in India that originally came from outside India

Why it connects to NRE vs NRO vs Resident Account

When people search NRE vs NRO vs Resident Account online, what they are really asking is: Where do I keep my Gulf salary so I do not get taxed twice and I can still move it out later. The answer is usually NRE.

Mistakes to avoid

-

Do not put Indian income here. Example: rent from a house in Kerala should not go into NRE.

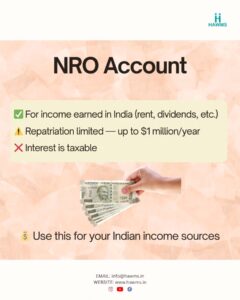

What is an NRO account

NRO stands for Non Resident Ordinary.

Who should use it

-

NRIs who still have income inside India.

Examples of India income

-

Rent from a house or flat in Kerala

-

Interest from deposits in India

-

Dividends

-

Pension or any India based earnings

Limits

-

Repatriation is allowed, but up to a limit per financial year and with process. You cannot just freely move unlimited NRO money out of India without paperwork.

Tax

-

Interest in NRO is taxable in India. The bank can cut tax at source.

Where this fits in NRE vs NRO vs Resident Account

Think of NRO as the account that safely holds India income and keeps it separate from your foreign salary. If you mix, it becomes hard to prove source. If you ever get asked to show where money came from, clean separation helps you.

What is a Resident account

This is the normal savings account people in India use.

Who should use it

-

People who live in India and are not NRIs.

Why this matters

If you have moved abroad and you still use your old resident account, that is a red flag. After you become an NRI, you are usually expected to convert that resident savings account to NRO. Leaving it as resident and continuing to use it can look like you are hiding NRI status.

This is one of the most common pain points in NRE vs NRO vs Resident Account. People do not update the bank, then later face issues when they try to transfer money or need tax proof.

Simple decision guide

You can use this flow to choose fast.

-

You earn only outside India

Use NRE. Your Gulf salary can come into India through NRE, and you can also freely send it back out. -

You earn in India

Use NRO. Rent from Kerala property, interest from Indian deposits, etc will sit in your NRO account. -

You live in India

Use a Resident savings account. If you are back in India for good, and now fully settled here, convert back.

Why this matters for NRE vs NRO vs Resident Account

Each account type is not just a bank product. It describes your status, your money source, and how you plan to use the money in the future.

Common mistakes NRIs make

These are the classic problems we see from Malayali NRIs in UAE, Qatar, Saudi, Oman.

Problem 1: Using a Resident account after moving abroad

Once you become an NRI, you should not continue with a normal resident savings account. You should convert it. If not, there can be compliance issues later, especially if there is a large balance.

Problem 2: Mixing Indian income and foreign income

Do not put rent from Kerala and Gulf salary into the same account. That makes it harder to explain sources during tax or remittance checks. Keep India income in NRO. Keep foreign income in NRE. This is the cleanest way to follow the logic of NRE vs NRO vs Resident Account.

Problem 3: Not informing the bank

When you move abroad, you are supposed to tell your bank and update KYC. Most people skip this because it feels annoying. Then it becomes a bigger issue when you try to move a large amount of money.

Problem 4: Not planning tax

Interest in NRE can be tax free in India. Interest in NRO is taxable. Resident account interest is taxable. If you never changed your account type, you might be paying tax in the wrong way or missing tax that you actually owe. Again, this is not theory. This is what leads to notice emails.

Quick FAQ

Do I have to close my old Resident account

Usually you convert it, not blindly close it. The bank will guide you to move to NRO.

Can I send money from NRE back to my Gulf account

Yes. That is one of the main reasons NRIs use NRE. You have flexibility.

Can I move funds from NRO to outside India

Yes, but it is controlled. You may need documents to show that tax is already paid on that money.

Is this only for very rich people

No. Even a normal salary worker with one flat in Kerala should set this up correctly.

Extra learning

If you want to understand investing discipline after you pick the right bank account, you can watch this YouTube video which answers common questions about SIP and how to start investing:

SIP Explained: Answers to the Most Asked Questions

This helps you go from basic banking to actual wealth building.

Also, if you want to see how we support clients with planning, tax clarity, and money systems, you can explore our services here

What you should do today

-

Check your current account type

Are you still using an old Resident account even though you work in the Gulf. If yes, talk to the bank and convert it. -

Separate income sources

Keep India income like rent and interest in NRO. Keep overseas salary in NRE. This keeps your paper trail clean. -

Keep proof

Save payslips, rent agreements, and bank statements. Makes life easy during tax checks. -

Ask early

Do not wait until you get blocked while sending money home or sending money back out. Get clarity now. -

Talk to a human

If you are still not sure where you stand in NRE vs NRO vs Resident Account, ask. It is easier to fix now than to fix after a notice.

Need help

If you are an NRI from Kerala and want someone to look at your accounts and tell you what to change, we can do that.

Chat with us on WhatsApp for a quick review. We will tell you which account you should actually be using, how to clean up old accounts, and how to keep tax safe.

This is personal money. Do not guess.