Kerala families want simple, clear money steps that actually work. If you are in Kerala or an NRI from Kerala, this guide shows a clean way to plan cash, gold, chit funds, and mutual funds. We will keep it practical and easy to act on. We will also answer a common question many people ask right now: How Malayalis can balance savings in 2025.

Why How Malayalis can balance savings in 2025 matters now

Life in Kerala has real-world costs that cannot be ignored. Flood season, medical bills for parents, school fees, and job changes can hit at once. Many families also hold a lot of jewellery gold and join informal savings groups. That is not always wrong, but balance and liquidity keep you safe. The goal is to protect your basics first, then grow with discipline.

1. Start with liquidity first

Before chasing returns, build a cash cushion you can use any day. This is the real foundation of How Malayalis can balance savings in 2025. Keep the first one to two months of expenses in your bank account. Park the next three to four months in liquid funds or short fixed deposits that you can break easily. This is your shock absorber for floods, hospital visits, and school payments. Do not invest this money in stocks or long deposits.

Action steps

-

Write down your monthly expense number.

-

Multiply by six to get the emergency fund target.

-

Automate a transfer on salary day into a separate account.

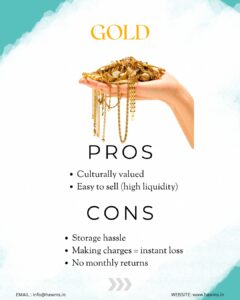

2. Right-size your gold

Gold is part of culture and a store of value, but jewellery has making charges and no monthly income. To make progress on How Malayalis can balance savings in 2025, treat gold as a small slice, not the core.

Action steps

-

Cap gold at 10 to 15 percent of your total savings.

-

Prefer 24k coins or ETFs over heavy jewellery.

-

Review family gold plans during wedding seasons so you do not overcommit.

3. Use SIPs for steady growth

Mutual fund SIPs bring discipline and diversification. They help you grow above inflation if you stay consistent. This is a central pillar in How Malayalis can balance savings in 2025.

Action steps

-

Start with broad index funds through a trusted platform.

-

Automate SIPs on salary day so you do not skip.

-

Increase SIPs when your income rises.

4. Handle chit funds with caution

Chit funds can force monthly saving, but quality varies and there is fraud risk. If you join one, make it a small part of your plan. This keeps you aligned with How Malayalis can balance savings in 2025 without taking on hidden risks.

Action steps

-

Only join well-known, regulated organizers.

-

Keep exposure small and time-bound.

-

Do not use chit funds as your emergency bucket.

5. Build an emergency fund for Kerala realities

Floods, medical needs, and travel can create spikes in spending. A clear buffer supports How Malayalis can balance savings in 2025 by protecting your long-term investments from forced selling.

Action steps

-

Keep at least six months of expenses in a mix of savings, liquid funds, and short deposits.

-

For flood-prone areas, add a small home repair reserve.

-

If you support parents, include their medicine and checkup costs in the monthly figure.

6. NRI money flows made simple

If you work in the Gulf and send money home, keep your accounts clean. This helps documentation, tax clarity, and smooth investing, which all support How Malayalis can balance savings in 2025.

Action steps

-

Use NRE for foreign income you bring to India.

-

Use NRO for rent, dividends, and other India income.

-

Keep proofs and avoid mixing sources in one account.

-

Invest through the correct account type so records stay clear.

7. A simple split that just works

Here is a balanced example many families can use as a starting point. It is not a one-size-fits-all rule, but it matches the logic of How Malayalis can balance savings in 2025.

Sample split

-

20 percent Emergency fund and short deposits

-

50 percent Mutual funds through monthly SIPs

-

15 percent Gold through coins or ETFs

-

15 percent Chit fund only if trusted, or move this slice to FDs if you prefer

How to start this month

-

Set the emergency fund target and begin an auto-transfer.

-

Start one SIP in a broad index fund.

-

If gold is above 15 percent, stop new jewellery buys and shift new savings to SIPs.

-

If you are in a risky or unregulated chit, reduce exposure over the next cycle.

8. Common mistakes to avoid

Learning How Malayalis can balance savings in 2025 also means avoiding traps that slow down progress.

-

Mixing emergency money with investments. Keep them separate.

-

Buying jewellery gold on EMI. Making charges plus interest is a double hit.

-

Stopping SIPs in a market dip. Stay steady.

-

Locking all cash in long FDs with penalties for early break.

-

Joining chits without checking the organizer’s record.

-

Ignoring insurance for parents and for yourself.

9. Mini calculator

-

Emergency fund target equals monthly expenses x 6.

-

SIP amount equals 20 percent of take-home to start.

-

Gold target equals 10 to 15 percent of total savings.

-

Rebalance once a year back to your chosen split.

10. Go deeper with a step-by-step plan

If you want a full five-year roadmap, read our earlier guide. It covers budgeting, clearing high interest debt, starting side income, and long-term investing. This article pairs perfectly with it and supports the same idea behind How Malayalis can balance savings in 2025.

Internal link

Read next: 5-Year Plan to Financial Freedom India

11. Get a quick personal map

Sometimes you just need a 10 minute check to set the right mix and automate it. If you want a simple, private review for your family, we can help. This is the fastest way to apply the ideas from How Malayalis can balance savings in 2025 to your own numbers.

-

We will review your cash, gold, chit, and SIPs.

-

We will suggest a clean split and automation steps.

-

You get a one-page plan you can follow every month.

Contact us on WhatsApp here: Chat with HAWMS

Final word

Balance and liquidity first. Growth next. Keep gold within limits. Use SIPs to build long-term wealth. Maintain a Kerala-ready emergency fund. Repeat these steps and review once a year. That is the core of How Malayalis can balance savings in 2025, and it is a path any consistent saver can follow.