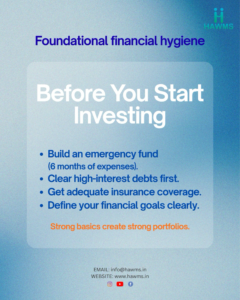

Most people want to grow their wealth, but only a few succeed because they jump into the market without understanding the basics. Before You Start Investing, you need to build a strong financial base that protects you from surprises and prepares you for long term success. This article breaks it down in simple, practical steps anyone can follow.

Why Before You Start Investing Matters More Than You Think

Many new investors rush into mutual funds, stocks, SIPs or even crypto because they feel they are losing time. But the truth is very simple. If your basics are weak, your portfolio will stay weak no matter how good the market performs. That is why Before You Start Investing is one of the most important personal finance steps for every Indian family. When you get this part right, everything that follows becomes easier, safer and more predictable.

1. Build an Emergency Fund

Every strong financial journey starts with safety. An emergency fund protects you from job loss, medical emergencies, sudden repairs or family responsibilities.

A good rule is to save at least three to six months of living expenses. This must be kept in a safe, liquid place like a savings account or liquid mutual fund.

When you follow the principles of Before You Start Investing, you won’t be forced to withdraw your investments early. Breaking a mutual fund or selling stocks during a bad market can cause huge losses. Your emergency fund prevents that and gives you mental peace.

2. Clear High Interest Debt

There is no point investing at 12 percent while your credit card is charging you 36 percent. Many Indian families start SIPs without clearing expensive loans. This is a mistake.

Make a list of all your loans. Clear high interest ones first – credit card dues, personal loans and buy now pay later payments.

By applying the ideas of Before You Start Investing, you make sure your investments are actually building wealth instead of fighting against your debts.

3. Get the Right Insurance Protection

Insurance is not for profit. It is for protection. A single medical emergency can wipe out five years of savings. That is why health insurance is mandatory.

Life insurance is also essential if your family depends on your income. The best option is term insurance – simple, affordable and transparent.

Insurance is a core part of Before You Start Investing because it ensures that your investment plan will not collapse due to one unexpected event.

4. Define Clear Financial Goals

You cannot invest blindly. Every rupee must have a purpose.

Ask yourself simple questions:

• What do I want to achieve

• How much money do I need

• By when

• What is my risk tolerance

Clear goals help you pick the right investment products. A goal based approach is one of the strongest habits in Before You Start Investing because it gives direction and discipline.

Examples of goals:

• Child education (15 years)

• Retirement (25 years)

• Buying land (8 years)

• Emergency fund (immediate)

• Home loan closure (10 years)

5. Understand Your Budget and Spending Pattern

Many people say they don’t have money to invest. But once they track their spending, they realise they are losing thousands on unnecessary purchases.

Budgeting is not about restrictions. It is about clarity.

A simple monthly budget can show where your money goes, how much you can save and how much you can invest confidently.

This is why budgeting is part of every Before You Start Investing checklist. Without it, you are driving your financial life with your eyes closed.

6. Start Small, Stay Consistent

Once your basics are strong, you can start investing confidently. You don’t need large amounts. Even a 500 rupee SIP can get you started. What matters is consistency, not the amount.

A strong Before You Start Investing mindset teaches you that wealth is created through discipline, not shortcuts.

7. Choose Simple and Safe Investment Options First

Many beginners feel overwhelmed. You don’t need complicated products. Start with simple, proven options.

Best options for beginners:

• Index funds

• Large cap mutual funds

• Liquid funds for emergency money

• PPF for long term safety

• Sovereign gold bonds for gold exposure

Once you grow and understand more, you can explore advanced products. But keep your foundation simple.

8. Avoid Common Beginner Mistakes

Even after doing everything correctly, many people fall for common traps:

• Investing based on friends’ tips

• Chasing past returns

• Watching the market daily

• Panic selling during market drops

• Investing without understanding the product

Remember, Before You Start Investing is not just a step. It is a mindset. When you focus on learning, planning and consistency, you won’t fall into these traps easily.

9. Build a Long Term Mindset

Investing is not a one year project. It is a lifelong commitment. Market will go up and down. Economic cycles will change. News will keep creating fear.

But long term investors always win because they stay invested through all phases.

The more you apply the principles of Before You Start Investing, the easier it becomes to stay calm during volatile times. You will understand that time in the market is more powerful than timing the market.

10. Review Your Plan Once a Year

You don’t need to check your investments daily. But a yearly review helps you stay on track. Check your:

• SIP amounts

• Fund performance

• Goals

• Insurance coverage

• Emergency fund status

• Debt levels

Small adjustments once a year keep your plan updated and effective.

Want to take your financial planning further

Read this next:

If you want personalised guidance for your financial goals, we are happy to help.